modified business tax id nevada

Account Numbers Needed. This tax is paid by the employer during a calendar quarter on amounts that exceed.

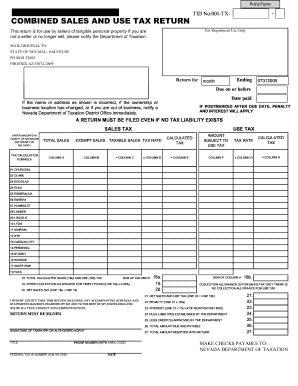

How To File And Pay Sales Tax In Nevada Taxvalet

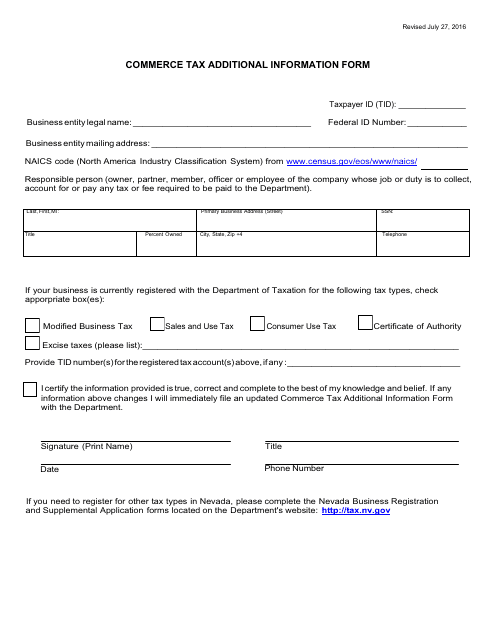

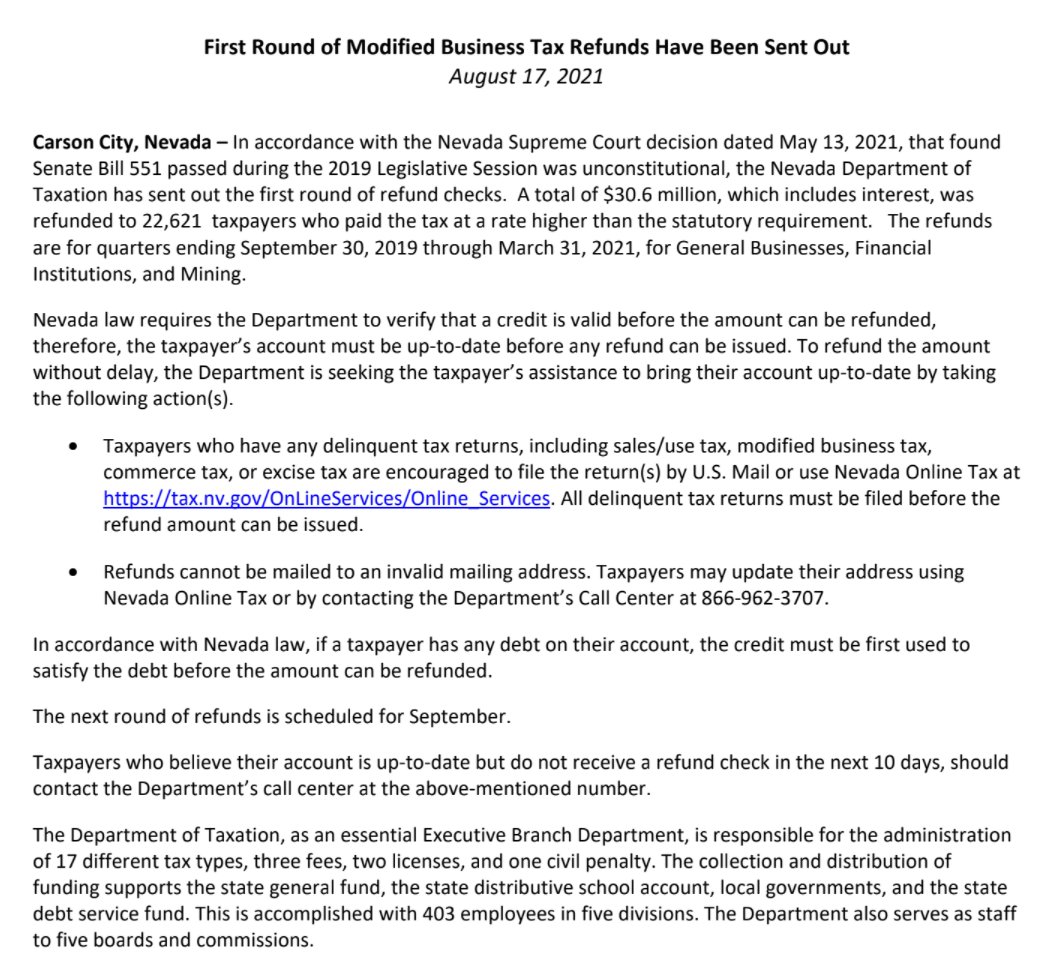

The Tax IDentification number TID is the permit number issued by the Department.

. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as. Modified business tax id nevada Thursday July 7 2022 Edit. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

In Nevada there is no state-level corporate income tax. How do I change my modified business tax return in Nevada. Clark County Tax Rate Increase - Effective January 1 2020.

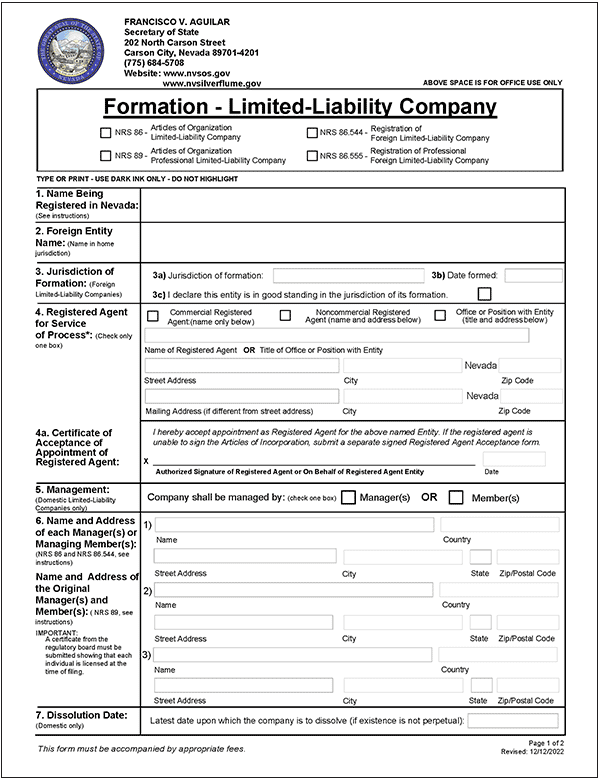

2 days agoSilverFlume is simple to use and offers the following corporate entity search options. Ask the Advisor Workshops. NV Business ID Number.

Enter the number as shown on your State Business License or. Search by Business Name. Click here to schedule an appointment.

Employers who pay employees in Nevada must register with the NV Department of Employment Training and Rehabilitation DETR for an. Enter your Nevada Tax Pre-Authorization Code. For assistance call 775-687-4545 Nevada Account Number or 866-962-3707 MBT Number.

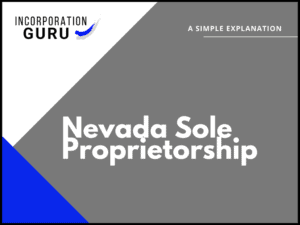

Imposition of excise tax at the rate of 1475 of the wages paid by an employer. Nevada Business ID Number. Searching the TID will list the specific taxpayer being researched with its affiliated locations.

However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter. Your Nevada Modified Business Tax number should be listed. SalesUse Tax Permit Modified Business Tax Department of Taxation Local Business License.

Email the amended return along with any additional documentation to email protected OR mail your amended. Once youve found your business click on the View Details button and scroll down to the Tax ID section. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the.

For additional questions about the Nevada Modified Business Tax see the following page from the. If you have quetions about the online permit application process you can contact the Department of Taxation via.

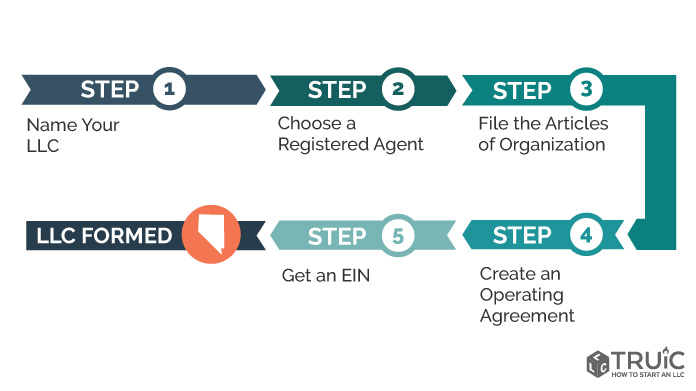

Nevada Llc How To Start An Llc In Nevada Truic

Nevada Sales Tax Fill Out And Sign Printable Pdf Template Signnow

Nevada Llc How To Start An Llc In Nevada Truic

Blayne Osborn Blayneosborn Twitter

Retail Assoc Of Nv Retailnv Twitter

Vinyl Decal Order Form Fill Out Sign Online Dochub

Htts Uitax Nvdetr Org Fill Out Sign Online Dochub

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Slt Nevada S New Tax Revenue Plan The Cpa Journal

How To Form An Llc In Nevada Llc Filing Nv Swyft Filings

Nevada State Tax Golddealer Com

2016 2022 Form Nv Dot Tid 020 Tx Fill Online Printable Fillable Blank Pdffiller

Nevada Treasurer Merchant Services

How To Become A Nevada Sole Proprietorship In 2022

City Of Lovelock Business License Application Packet Pdf Free Download

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

Ppt State Of Nevada Department Of Taxation Powerpoint Presentation Free Download Id 4470648